Bottom line [1]

If no new, massive shocks hit the Canadian economy, then over the next two years we expect that inflation will be back on track, in the 1 to 3 per cent range, and centred on 2 per cent. Our previous post on the Bank of Canada’s overnight rate is that it will have declined to somewhere between 2 and 3 per cent, likely closer to 3 per cent.

We are assuming that the federal government is successful with their planned reduction of the growth of non-permanent residents over 2024 and 2025 (undergraduate students and temporary foreign workers), after the temporary surge occurred in 2022 and 2023, notably of post-secondary students. [2]

Hopefully by the end of 2025 various housing initiatives (in partnership between different levels of government, and the private sector) will be bearing fruit and housing supply elasticity will have improved. Expanding housing supply and a faster expansion in the future in respond to housing demand would go along way to keep housing affordable for everyone in Canada. More and more appropriate housing can also keep more people from becoming homeless or precariously housed. Housing is the single largest component of the consumer price index, and so it can drag inflation higher all on its own.

To understand how various initiatives are functioning, will require monitoring housing stats, and housing costs, along with seeing if the implementation of changes to zoning and other factors is making housing supply more responsive to demand. We need to continue to monitor both population and labour force statistics (labour force participation rates, unemployment, average wages) by age group, if someone is a newcomer, indigenous and other factors.

We also need to monitor ways to make Canada and Manitoba more investable, and boost productivity. While not mentioned in the speech, these can include finding ways to more rapidly decide to build new infrastructure, and to speed the building process.

Analysis Report

Tiff Macklem, Governor of the Bank of Canada’s spoke to the Winnipeg Chamber of Commerce on June 24, 2024. The text of the speech was released shortly after the event. https://www.bankofcanada.ca/2024/06/making-labour-market-work-everyone/

Why price stability is important

The Bank of Canada’s primary mandate is price stability (low, stable and predictable inflation).[3] Price stability improves confidence by reducing price uncertainty. This encourages spending and investing, which contributes to sustainable job creation and productivity growth. Rising productivity leads to a rising standard of living.

Price stability is aided by well-balanced labour supply and demand (where those people who want to work are doing so, and where jobs required by employers are filled). This is also where wage growth is aligned with productivity growth. Macroeconomists call this maximum sustainable employment .

- If unemployment is too low, price inflation occurs.

- If unemployment is too high, price deflation occurs, although wages tend not to fall.

Recognizing this importance, the Bank of Canada is analyzing the Canadian labour market in greater depth using a dashboard of labour market indicators. [4]

It is important to note that wage gains that reflect productivity improvements do not increase unit labour costs or inflationary pressures. If wages growth reflects valuable new skills or better job matching, it should not increase unit labour costs and inflation.

For example, what happens to inflation pressures due to wages? Let’s say, if wages averaged $20/hour in year 1 and increased by 10 per cent to $22/hour in year 2. If productivity gains from year 1 to year 2 were 10 per cent, then there is no inflation pressure. Only if wage growth is faster than productivity growth does inflation pressure result from wage gains.

Overall adjustment since 2020

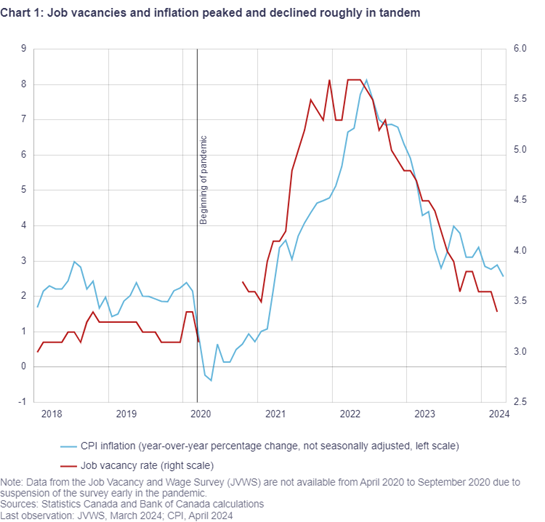

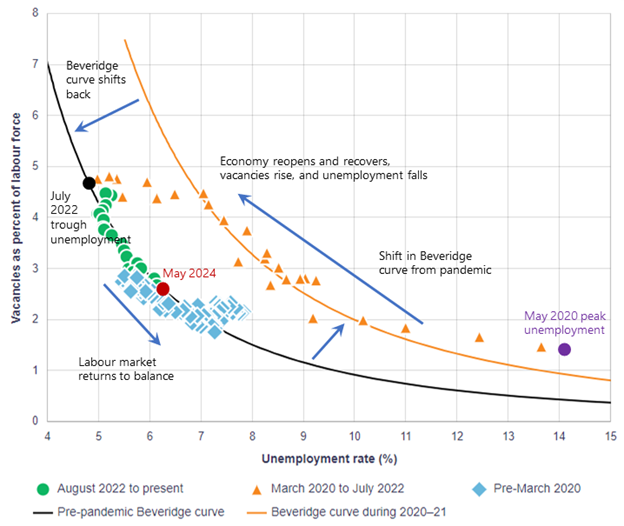

While we have seen some wide swings in the relationship between vacancies as a share of the labour force and the unemployment rate, the May 2024 statistics mean that job vacancies can fall substantially without increasing unemployment rates significantly.[5] See Chart 1, job vacancies and inflation both peaked in mid-2022.

It is possible that Canada achieves a soft-landing situation, something that the Bank of Canada has attempted to achieve with how it has conducted its monetary policy since July 2022.[6]

It is rare that unemployment rates by industries and occupations are identical to the overall unemployment rate. This is something we have observed using the Labour Force Survey (LFS), Survey of employment, payroll and hours (SEPH), and productivity accounts.[7]

As of the latest statistics, new graduates, younger workers and newcomers are having a harder time finding a job.[8] The unemployment slack for newcomers gives room for the federal government to slow the growth of non-permanent residents, as they have been started doing early in 2024,[9] without introducing labour market tightness.

Governor Macklem noted that the elevated unemployment rates for young people and newcomers is suggestive that the economy has room to grow and add jobs without adding inflationary pressures. These groups are facing financial stress, showing up as late payment on credit cards, auto loans (particularly for renters), and rising insolvencies.[10]

The labour market and long-run growth

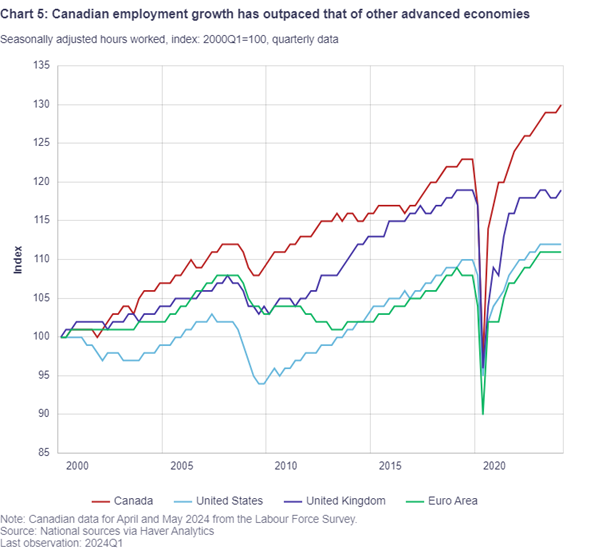

Canada has strong employment growth, as indicated in Chart 5 above. Three factors underpin this strength. These include a high labour force participation rate (LFP), strong immigration and a good education system. Canada’s women have the top LFP rate in the G7 for women, due to affordable childcare and flexible work arrangements. Canada’s strong immigration,[11] enables the country to attract the best and the brightest students and workers, while rapidly integrating newcomers. Canada’s education does a reasonable job developing workers that are needed by the economy and that businesses want to hire.

So, while Canada has been doing well at adding workers to the economy, the country has been struggling to grow our output per worker. Productivity growth is a long-standing issue in Canada.

Governor Macklem noted that growing our labour force is one of Canada’s strengths. But we also need to tackle our weaknesses: a lack of investment and weak productivity growth.

Labour force advantage

To maintain and build on Canada’s labour force advantage, we need to:

- Further improve childcare accessibility

- Improve the LFP rate among those who are too often excluded e.g. indigenous peoples,

- Align immigration to help fill labour market gaps, e.g., select trades,

- Properly recognize immigrants’ credentials, qualifications and foreign work experience.

- Sustain/enhance our education system.

Productivity Growth

Why is productivity growth important? It keeps Canadian businesses competitive in international markets, enables wage growth, and higher living standards.

A recent analytical note from the Bank of Canada, looks at Total Factor Productivity (TFP) growth in Canada.[12] Digitization, population aging and the impact of climate change policies are expected to affect Canada’s TFP.

Investment:

Canada needs to increase its investment per worker, which has slowed since the mid-2000s.[13] Lower investment in machinery and equipment (esp. ICT), and intellectual property leave Canadian workers at a disadvantage. How do we make Canada more investable?

High-level factors driving economic growth

While this was not mentioned in the speech, we know that there are six high level factors that support economic growth. Infrastructure, education, research and development, a well-functioning financial system, the protection of property rights, and political stability and good governance. Canada typically has a well-functioning financial system, protecting property rights and political stability and good governance.

Where we have fallen off or we could do better is investing in infrastructure [At times our processes often take much longer than they used to (to approve private or public projects), and the decision to invest in public infrastructure often takes much longer than it used to]. The problems with housing supply shortages vs housing demand is also driving house prices up, and thus distorting how much gets invested in housing, vs other development opportunities.

We can also improve our education system, and research and development investment. Government programs need to be updated to improve private R&D and IP growth. There is a federal review going on in 2024 with the aim of improving government programs.[14]

Appendix

The Beveridge curve

See pages 4 – 5, Macklem June 24 speech. Recently job vacancies have declined substantially, and unemployment has edged up.

Sources: Statistics Canada, Indeed and Bank of Canada calculations, Last observation: May 2024.

END NOTES

[1] This bottom line is some of my thoughts on implications of the speech by Governor Macklem in late June to the Winnipeg Chamber of Commerce. You can read the text of his speech here.

[2] See Chris Ferris (January 24, 2024). https://www.economicdevelopmentwinnipeg.com/media/winnipeg-economic-digest/read,post/1030/implications-of-recent-changes-to-ircc-study-permit-rules, WED Vol. 3, Issue 1.

[3] The Bank of Canada is just as interested in boosting inflation from below target as it is decreasing inflation from above target. The target being two per cent, the mid-point of its one to three per cent operating band.

[4] The Bank of Canada refreshed its Dashboard of Labour Market Indicators most recently in Staff Analytical Note 2024-08.

[5] See appendix, The Beveridge curve.

[6] See Chris Ferris (July 15, 2022) July 2022: Inflation Factors and Expected Monetary Policy Actions | Winnipeg Economic Digest | Economic Development Winnipeg, WED Vol. 1, Issue 1, the Inflation forecast review subsection. Also see Hard or soft landing? (bis.org).

[7] See Chris Ferris (January 18, 2023). https://www.economicdevelopmentwinnipeg.com/media/... Winnipeg Economic Digest (WED), Volume 2, Issue 1.

[8] This requires monitoring, to inform policy action.

[9] See Chris Ferris (January 24, 2024). https://www.economicdevelopmentwinnipeg.com/media/... WED Vol. 3, Issue 1.

[10] See the charts related to Manitoba consumer and business insolvencies in Chris Ferris (April 18, 2024). https://www.economicdevelopmentwinnipeg.com/upload... for CAIRP Winnipeg Forum, pages 35 – 40.

[11] See Canada’s Q1 2024 estimate of population growth, released June 19, 2024. https://www150.statcan.gc.ca/n1/daily-quotidien/24...

[12] Brouillette, Davakos, and Wheesk (May 2024), “Total factor productivity growth projection for Canada: A sectoral approach,” Staff Analytical Note, 2024-12, https://www.bankofcanada.ca/2024/05/staff-analytic...

[13] See the Statistics Canada study in the Analytical Studies Branch Research Paper Series: Wulong Gu (February 22, 2024). “Investment Slowdown in Canada After the Mid-2000s: The Role of Competition and Intangibles,” https://doi.org/10.25318/11f0019m2024001-eng.

[14] Government of Canada launches consultations on SR&ED modernization | BetaKit, and the Scientific Research and Experimental Development (SR&ED) tax incentives program (https://www.canada.ca/en/revenue-agency/services/s... and other inducements of private R&D.