Starting in November 2024, Donald Trump promised to impose tariffs against goods being imported from Canada, Mexico and China. He claimed the U.S. is subsidizing Canada through trade deficits, and that illegal immigrants and fentanyl are entering the U.S. from Canada.

These arguments are based on falsities. It is important for Winnipeggers, and Canadians, to know the economic facts that rebut how President Trump is justifying his tariff threat.

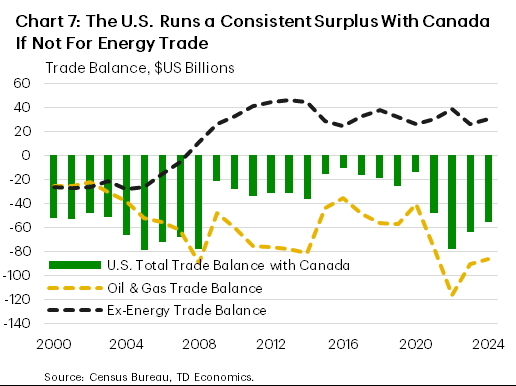

Let’s look at the trade deficit. When we strip away energy exports (see black dotted line on the chart above, source: TD Economics), which are predominantly accounted for by exports of Western Canadian Select (WCS) oil, we can see the U.S. is in fact running a trade surplus with Canada.

The U.S. exports West Texas Intermediate (WTI) to the global oil market while importing Western Canadian Select (WCS) for domestic use. WCS is sold to the U.S. at a lower price than what WTI fetches internationally, making it a favorable arrangement for both countries. However, this economic interdependence has yet to persuade President Trump of its mutual benefits. Instead, he has continued to issue counterproductive executive orders that harm trade on both sides of the border. On February 1st, Trump signed an executive order to introduce 25 per cent tariffs against all imports from Canada and Mexico, just to grant a 30-day extension.

On February 10th, Trump announced 25 per cent tariffs on all steel and aluminum products entering the U.S., no exceptions, effective March 12th.

What is the endgame for the Trump administration? To start, the United States-Mexico-Canada Agreement (USMCA) – which was signed by Trump himself, who described it as “a very, very good deal for all three [countries]” – is being renegotiated in 2026. The tariff threats are an attempt to weaken the Canadian economy and force us into a new agreement that is more favourable for the U.S., at our own expense. The initial USMCA agreement was signed under similar conditions and ended up looking very similar to NAFTA. This time, it is unlikely the outcome will be much different.

What is the endgame for the Trump administration? To start, the United States-Mexico-Canada Agreement (USMCA) – which was signed by Trump himself, who described it as “a very, very good deal for all three [countries]” – is being renegotiated in 2026. The tariff threats are an attempt to weaken the Canadian economy and force us into a new agreement that is more favourable for the U.S., at our own expense. The initial USMCA agreement was signed under similar conditions and ended up looking very similar to NAFTA. This time, it is unlikely the outcome will be much different.

Trump is also attempting to realize a dream of the U.S. experiencing a manufacturing renaissance. Even if it was in the best interest of the U.S. to bring back as much manufacturing as possible, tariffs are not the optimal mechanism to achieve that goal. Former senator and economist Phill Gramm and prominent economist Larry Summers published an open letter to Trump expressing their opposition to the use of tariffs as an economic/political policy tool, which was signed by more than 1,000 American professional economists.

It is still worth considering what would happen if the 25 per cent tariffs were levied against Canada and Mexico. In that scenario, it has been estimated that U.S. GDP would decline by one percentage point (Royal Bank of Canada), while Canadian GDP would decline by somewhere between two to three percentage points (Bank of Canada). The effect of this will be higher prices for consumers on both sides of the border.

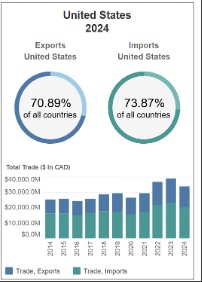

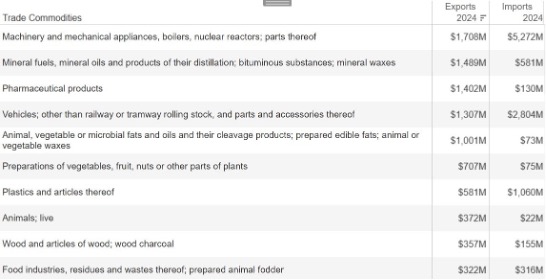

What would tariffs mean for Winnipeg and Manitoba? In 2024, approximately 70.89 per cent of Manitoba’s exports went to the U.S., while we sourced 73.87 per cent of our imports from them (see the chart below of the top 10 products that Manitoba exported to the U.S. in 2024). The top five products each exceeded more than $1 billion CAD in exports and each of the remaining products accounted for $300-$700 million CAD in exports.

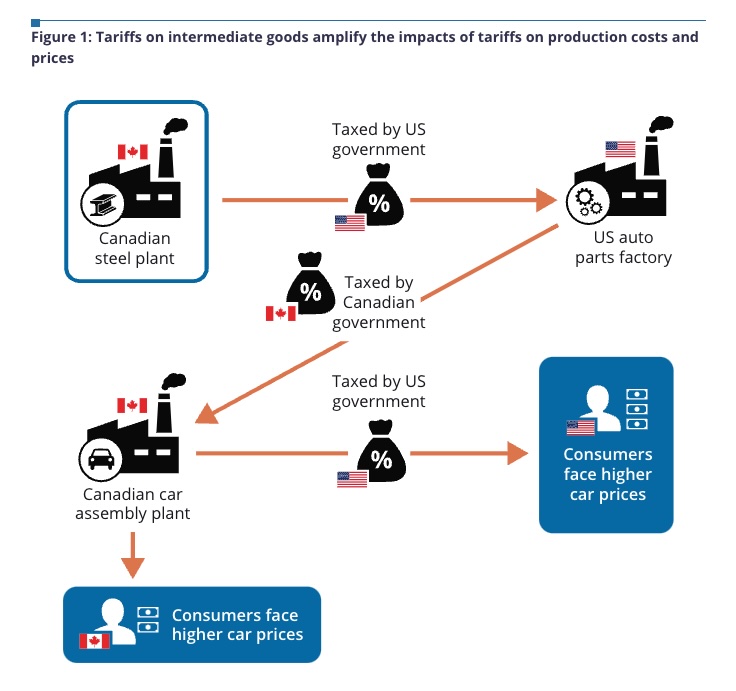

Tariffs would not impact all the exports equally, and the impact depends on several factors. Can the product be produced domestically in sufficient quantities, and if so, how easily can the purchaser find an alternate source of the product (domestically or from a non-tariffed country)? How often does the product cross the border? Consider the infographic, below, from the Bank of Canada. It shows how universal tariffs will increase the cost of an automobile, which is jointly built in Canada and the U.S., with parts moving back and forth. Other goods that are produced this way will be more heavily impacted than final goods, such as wheat and grains, which are exported to the U.S. and then consumed immediately (in this case being baked into bread).

Bank of Canada Infographic

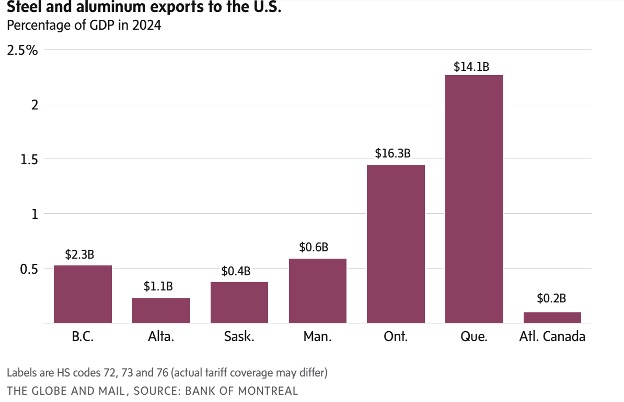

If the tariffs were targeted against a smaller set of goods and services, Winnipeg and Manitoba are well suited to absorb this type of shock because our exports span a wide array of sectors, which effectively spreads the risk evenly across each of these. For example, Steel and Aluminum exports from Manitoba to the US account for just over 0.5% of provincial GDP (see chart from the Globe and Mail). This would still have an impact on the local economy; however, the impact would be much smaller compared to other provinces, notably Quebec and Ontario. Furthermore, it does not imply that GDP would fall by 0.5 percentage points.

Without the introduction of tariffs, GDP growth for Manitoba is projected to be 1.4 per cent in 2025. With the new tariff threats, the bank of Canada has adjusted GDP growth downwards by 0.3 percentage points to roughly 1.1 per cent. Tariffs, of any variety, would reduce that estimate—even the threat of tariffs is imposing an “uncertainty tax” onto the Canadian economy. Locally, this will dampen Foreign Direct Investments in Winnipeg this year. As for tourism, a weaker dollar can help to increase or at least sustain the number of visitors to Winnipeg, from abroad and domestically.

Going forward, the recent tariff threats may well force some positive changes onto the country which will open new opportunities. Specifically, Canadians are increasingly looking to Europe and the Pacific—both regions with established trade agreements with Canada—as alternative export destinations.

In addition, a lot of attention has been redirected towards removing barriers to interprovincial trade. As it stands, the Western Canadian provinces have fewer barriers in place than the rest of Canada, however, there is still progress to be made. Winnipeg and Manitoba could benefit greatly from increased internal and international trade. Notably, the Port of Churchill recently received nearly $79 million in funding, which will allow for continued redevelopment of the port and connected railway. This will further bolster Winnipeg’s status as a transport hub and lessen our dependence on Vancouver and the St. Lawrence River to access major seaways for more direct trade with markets outside of North America.

The current threat of tariffs has injected a high degree of uncertainty into Canada’s economic forecast. For Winnipeg, multiple economic factors position us well to reduce our reliance on the U.S. market and expand into broader interprovincial and international trade. In the short run, our diverse economy will help to absorb the shock of tariffs should they be imposed.

Daniel Tingskou is Economic Development Winnipeg's economist.